How Best Financial Planners Melbourne can Save You Time, Stress, and Money.

Table of ContentsGet This Report about Finance Brokers MelbourneAll About Best Financial Planners MelbourneAll About Best Financial Planners MelbourneExcitement About Best Financial Planners MelbourneThings about Finance Brokers MelbourneThe Only Guide to Best Financial Planner Melbourne

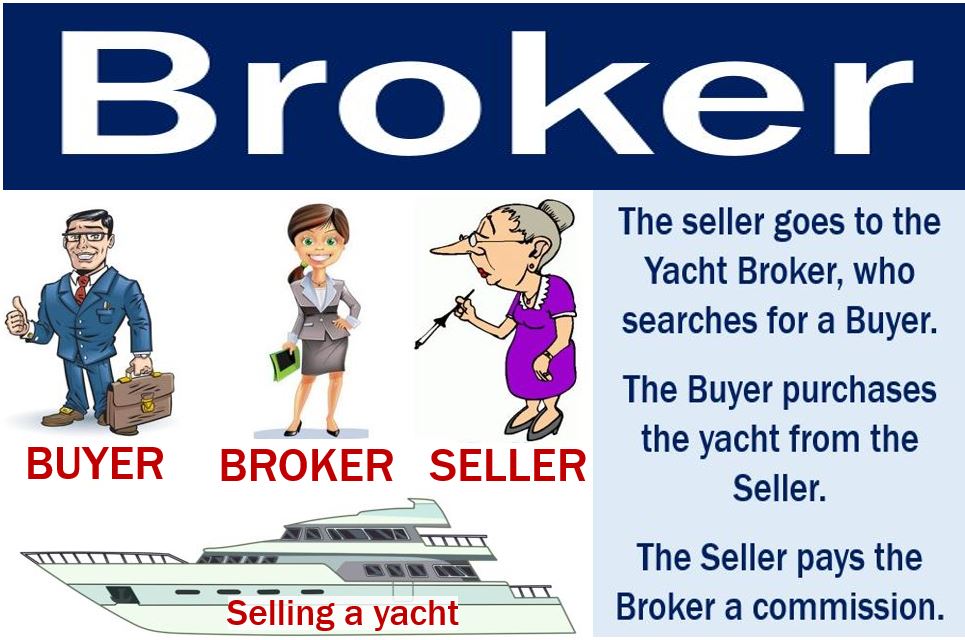

A broker is an intermediary in between customers and manufacturers (of services). There are brokers in insurance, property, lorry sales, and so on. The main purpose of this type of broker is to offer budget friendly rates to its consumers by playing on the amounts on the manufacturer's side. The broker we want right here is the supply exchange broker.(There are actually couple of brokers headquartered in France because the policy, in favour of customers, is very hefty, limiting, taxing as well as expensive.) The rise of the Internet has made it possible for the advancement of private trading and also consequently of brokers' activities. In the past, you had to go to your financial institution or make a phone call to buy or market an economic item; now you simply need to attach to the Net, open your trading work terminal, and also in a couple clicks, the order is positioned, the resources gains conserved and also moved to your bank account.

This has obviously caused excellent and negative effects for the sector. On the positive side, financial markets have progressed as increasingly more people have started trading extra, much better and also much more frequently. New monetary items have emerged that permit everybody to locate the appropriate match for their demands according to their expectations, purposes, timetables as well as financial resources.

The broker manages your trading account. He/she implements your market access and also departure orders and charges a commission for this. He/she is the intermediary in between you as well as the market. You can not trade without a broker yet this does not excluded you from taking note of the solutions supplied. Your broker needs to have direct accessibility to the markets you want to trade in, without any kind of intermediary.

Fascination About Melbourne Finance Broker

In order to allow their clients to sell the Foreign exchange market, some brokers (but not all) do not charge you a compensation yet propose a spread. The spread is the distinction in between the purchase cost (ask) and the list price (quote). The advantage for a trader to patronize spread is that there is no commission (finance brokers melbourne).

New kinds of brokers are emerging. The first category belongs to financial institution brokers. For a long period of time, banks have actually been the only monetary intermediary for a private individual. As we have actually seen, technical advancements have actually allowed everyone to intervene straight on the market. So what is the factor of asking your bank to position an order? Increasingly more clients have therefore transformed away from their financial institution to (1) manage their own trading resources (financial information has revealed the weaknesses of traditional banks such as banks); (2) reduce stock exchange or bank costs (by getting rid of an intermediary, costs are minimized).

These on the internet banks/brokers strongly connect in the media ("my banker is me"). Full Report A 2nd classification of "new" brokers consists of discount rate brokers, market makers as well as other Forex brokers. These middlemans do not bill a brokerage firm compensation, but do demand high spreads. It is also feasible to open trading accounts cost free (any type of account opening, despite the broker, is absolutely free anyway) as well as a lot more significantly with no financial minimum (along with the margin for futures).

There is no longer any admission ticket, every person can play on the markets, which is a joy for educated and also specialist traders. Commonly, these brokers also offer cost-free trading training.

The Definitive Guide for Finance Brokers Melbourne

A 3rd category of brokers are not in fact brokers. They are called initial brokers (IB). It is merely a client opening trading accounts for his regular broker.

Today, the majority of discount brokerages offer their clients with zero-commission stock trading The companies are able to offset this loss of profits by getting repayments from the exchanges for big orders and trading fees for other products like common funds and bonds, There are different sort of brokers such as discount brokers and full-service brokers.

Brokerage companies create earnings from trading commissions, monitoring charges and also rate of interest margin. There are two types of brokerage firm companies. Full-service broker agent firm gives a variety of monetary solutions. This type of company allows you to acquire and also market protections. The primary goal of these banks is to provide monetary consulting.

Property broker represents the owner of the property and also generates income from try this website the commission received.

Getting The Best Financial Planner Melbourne To Work

To obtain right into these courses you typically require to get your Senior Additional Certificate of Education And Learning. Prerequisite topics, or presumed expertise, in one or more of English and maths are typically needed. Universities have various requirements as well as some have adaptable entrance requirements or deal external research study. Contact the organizations you are interested in to find out more.

Today, the majority of discount brokerage firms give their customers with zero-commission supply trading The companies have the ability to offset this loss of profits by obtaining settlements from the exchanges for big orders and trading fees for other goods like common funds as well as bonds, There are different sort of brokers such as discount rate brokers and full-service brokers.

Brokerage firm companies create earnings from trading payments, administration costs as well as passion margin. There are two kinds of brokerage firm firms. Full-service brokerage company gives a variety of economic services. This sort of firm permits you to deal safety and securities. The major objective of these banks is to provide economic consulting.

Property broker promotes the owner of the residential or commercial property as well as creates revenue from the commission obtained.

The Main Principles Of Best Financial Planners Melbourne

To get right into these programs you normally need to gain your Elderly Additional Certificate of Education And Learning. Requirement subjects, or thought understanding, in several of English and maths are typically called for. Colleges have different requirements and some have adaptable entry requirements or offer external study. Get in touch with the institutions you are interested in for additional information.

Today, the bulk of discount rate brokerages provide their customers go to my site with zero-commission supply trading The companies have the ability to offset this loss of income by obtaining settlements from the exchanges for big orders and trading fees for various other products like mutual funds and also bonds, There are various type of brokers such as discount brokers and also full-service brokers.

Full-service brokerage company supplies a broad variety of economic solutions. The main goal of these economic establishments is to offer monetary consulting.

Realty broker represents the owner of the residential property and produces revenue from the compensation received.

The Best Strategy To Use For Melbourne Finance Broking